MyCardStatement is an online portal designed to assist individuals, especially credit card holders, in effectively managing their finances. With MyCardStatement, people can gain better control over their financial matters and make informed decisions.

Are you curious about Mycardstatement and the benefits of using this online payment portal? If so, this blog post is for you. Here, we will provide an in-depth analysis of Mycardstatement, including the registration process, login process, benefits, features, and login requirements. We will also discuss the basic access guidelines to help you make the most of this service. By the end of this post, you will have a comprehensive understanding of My card statement and how it can help you manage your finances.

What is MyCardStatement?

MyCardStatement is an online portal that allows users to access their card statements, view account balance and transactions, and manage their personal finances. This platform offers users a secure and convenient way to stay organized and updated with their financial information. With MyCardStatement, users can easily keep track of spending habits and make payments through the web or mobile app. The portal offers many features, such as budgeting tools, credit score monitoring, and fraud protection.

Users who enroll in autopay will receive alerts for payments due soon, notifications about changes in rates and fees, and other critical updates on their accounts. The myCardStatement website has a clean interface and is user-friendly. It provides users with quick links to key areas of the site, so they are able to find what they need quickly without much hassle. The registration process is fairly straightforward; enter your email address, create a password and agree to the terms of service (to use this free service).

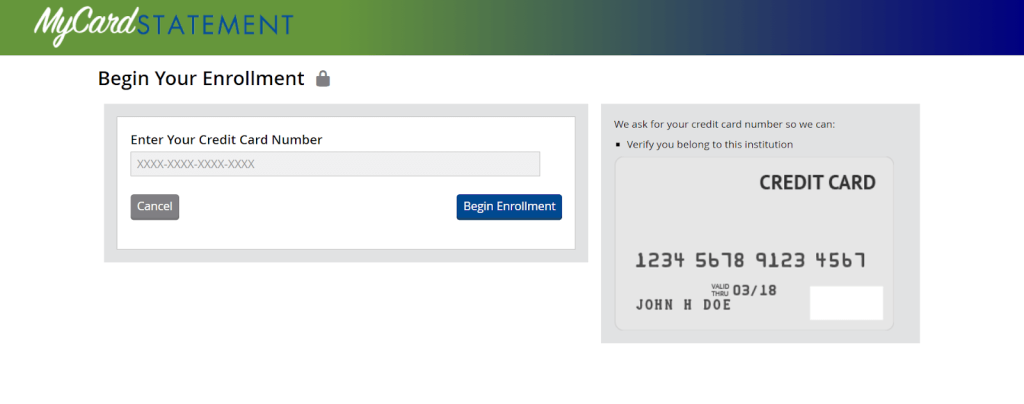

Registering for mycardstatement

- Visit the mycardstatement website and click on Register to begin the registration process.

- Enter your personal information, including name, address, and phone number.

- Create a username and password that meets the security requirements of mycardstatement.

- Provide information about your credit cards, such as the cardholder’s name, card number, expiration date, and security code.

- Confirm the accuracy of your information and click Submit to complete the registration process.

- You will receive a confirmation email with your username and password and instructions on how to log in to your mycardstatement account.

- Once logged in, review the Terms of Use and Privacy Policy, then click Agree to accept the agreement.

- Select your preferred security questions to protect your account from unauthorized access.

- Add any additional credit cards to your account that you would like to monitor or pay with mycardstatement.

- Verify the accuracy of your account information and select Save to finalize your registration for mycardstatement.

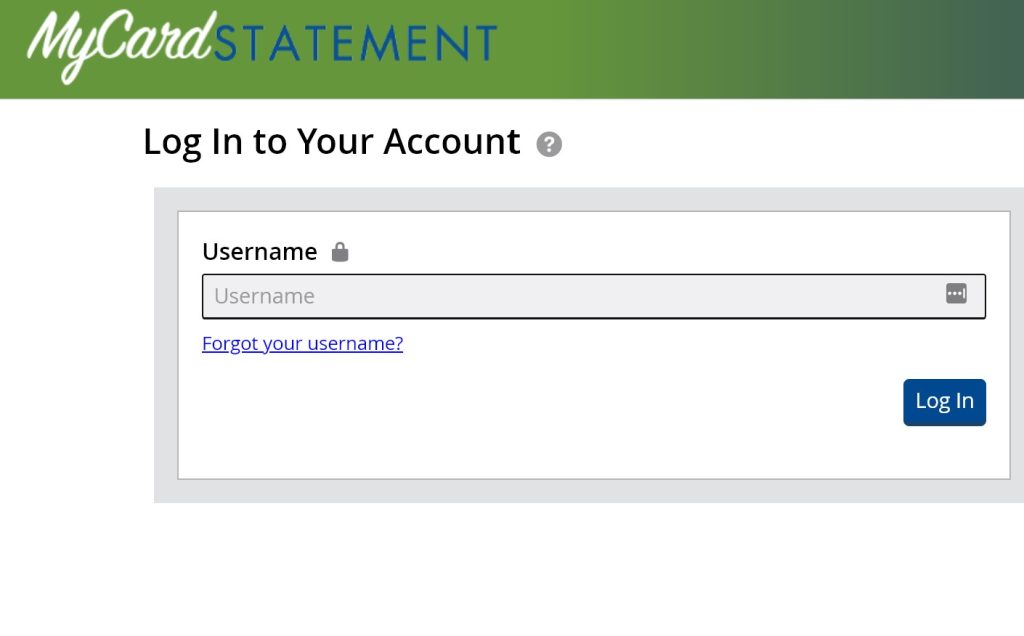

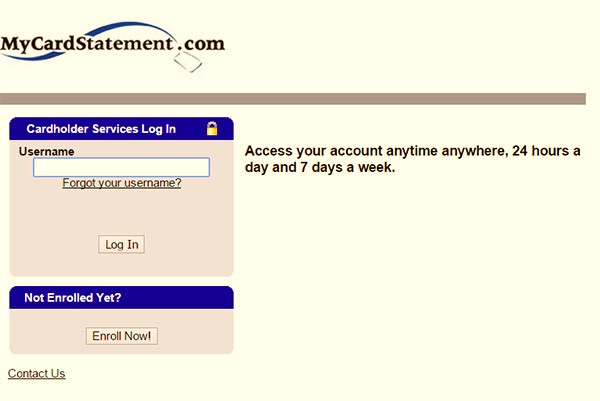

Logging into your mycardstatement account

Your login ID and password are now active, so be sure to keep them private by not sharing them with anyone else. If you’ve forgotten your login ID or password, don’t worry! Mycardstatement allows you to retrieve them by answering two of your own security questions that were created during registration. Logging into MyCardStatment is a quick and easy process that can be completed in five steps.

The first step requires the user to enter their username and password. After this, the user enters their account PIN followed by their full name. The fourth step requires the user to join their date of birth before finally entering their final PIN, which was generated when they set up their account, as well as adding an emergency contact. From there, the new cardholder can log in using the same username and password used for registration if they need assistance logging in at any time.

1: Go to MyCardStatment’s official website

Go to MyCardStatment’s official website and create your free account. MyCardStatment is an online portal for managing your credit card transactions. The website offers a secure environment for making payments and managing your credit cards. Once you sign up, you will be able to view all of your account information and payment history in one convenient place. To begin, simply visit the website and follow the easy step-by-step instructions. You can access the website from any device with an internet connection. Signing up is fast and simple, and you can start managing your account immediately.

2: Add username or e-mail

Adding a username or e-mail to your mycardstatement account is a simple process. First, you must open the mycardstatement website and log in with your account details. Once you have logged in, click on the My Account tab in the top right corner of the screen. Next, select the Add Username or Email option from the menu. On this page, you can enter the username or e-mail address you wish to use for your account.

3: Enter the password

When creating a password for Mycardstatement, it is important to use one that is both secure and easy to remember. It is recommended to use at least eight characters, including both uppercase and lowercase letters, numbers, and special symbols like !@#$%^&*. It is also recommended to avoid using passwords that include easily guessable information such as your name, birth date, address, or phone number. Additionally, you should try changing your password every few months to ensure security.

4: Verify the information

Verifying the login information is very important for anyone accessing the Mycardstatement portal. To verify your credentials, you will need to provide valid proof of identity (e.g., passport, driver’s license, or national ID card) and proof of residence (e.g., utility bill or bank statement). Once you have provided this information, Mycardstatement will review your credentials and approve or reject them. Once approved, you can move on to the next step of logging in to the portal.

The benefits of using the mycardstatement portal

Here we are talking about some benefits of using the mycardstatement portal:

1: MyCardStatement portal enables to monitor of current transactions

MyCardStatement is an online portal that allows you to monitor and manage your current credit card transactions. It provides a comprehensive view of all your payments and purchases in one place, giving you greater control over your spending. With MyCardStatement, you can easily check your current balance and view detailed information about recent transactions. You can also set up alerts for when payments are due and track your rewards points.

2: MyCardStatement offers a secure way to access your account.

When registering for an account, you must provide personal information such as your name, address, and date of birth. This data verifies your identity and creates a secure login ID. Once you have completed the registration process, you will be given a secure password to access your account. You will also be able to set up two-step authentication for added security.

3: MyCardStatement makes it easy to keep track of your spending.

With the portal, you can view a summary of all current transactions and track any suspicious activity. You can also set up email or text alerts to notify you when payments are due or when funds are transferred from your account. Additionally, MyCardStatement allows you to monitor rewards points, so you can always ensure you’re taking advantage of the best available offers.

4: Convenient

Overall, MyCardStatement provides a convenient way to stay on top of your credit card transactions. With its secure login process and detailed overviews of your activity, it’s an excellent tool for managing your finances and keeping track of spending. Whether you’re new to using credit cards or just want to stay better organized, MyCardStatement can help make life easier.

5: MyCardSatement portal provide paperless statements through websites

MyCardStatement portal allows users to access their account information and statements securely and conveniently without needing paper documents. Users can access their statements, pay bills, check balances, and more in real time through its website. This is an efficient way for customers to manage their finances without waiting for paper statements or carrying bulky paperwork. By providing paperless statements, the MyCardStatement portal helps users save time and money while being environmentally conscious.

6: With the mycardstatement portal, it is easy to view financial statements

With the mycardstatement portal, it is easier than ever to view your financial statements. The portal makes it easy to access your card’s activity, view balance summaries, and track payments. You can also better understand your spending habits and make adjustments as needed. With secure and convenient access to your financial information, the mycardstatement portal simplifies the process of staying on top of your finances.

7: The mycardstatement portal gives expense reports of your account

The mycardstatement portal is a beneficial tool that allows you to keep track of your finances and manage them more efficiently. One of its great features is the ability to generate expense reports. You can easily see where your money is going and get a clear picture of your spending habits. This helps you to gain control of your finances and make smarter decisions about how you use your money. Additionally, the expense report feature allows you to set up alerts that let you know when you are exceeding your budget. With this feature, you can ensure that you stay on track with your financial goals.

The features of the mycardstatement portal

Here are some features of the mycardstatement portal:

1: Analysis of recurring expenses by mycardstatement

Mycardstatement is an online portal that helps users to manage their financial information and monitor their spending habits. Through Mycardstatement, users can access their account information, view their statements, and set up automatic payments for recurring expenses. This makes it easier for customers to stay on top of their finances and identify potential issues. With this service, users can track and analyze their spending patterns and identify recurring expenses, allowing them to make informed decisions about their finances.

2: Statement check through mycardstatement

Statement check through mycardstatement is a convenient and secure way to check your account activity online. Through the mycardstatement portal, you can access your statements anytime, anywhere, with an internet connection. You can check your balance, review recent transactions, and even download monthly reports for printing or sharing. The portal is easy to use and provides peace of mind knowing that your information is secure and up-to-date.

3: Pay online bills through mycardstatement

Mycardstatement provides a secure and convenient way for customers to pay their bills online. This portal allows customers to easily view and manage their accounts, make payments, and monitor activity. The portal also offers other features, such as auto-pay and reminders, that help customers stay on top of their finances. With the help of my card statement, customers can save time and money while reducing their risk of late payments.

4: Apply online for your credit card through

Applying for a credit card online has never been easier than it is today. You can apply for your credit card right from the comfort of your home, using just a few clicks. Mycardstatement offers an online application process that allows you to fill out the necessary forms in no time. You can also use their secure online system to track your application’s progress and ensure everything is in order before submitting.

What you need to know before logging into your mycardstatement account

Before logging into your mycardstatement account, it is important to understand the registration process and the benefits of using the mycardstatement portal. To register, you will need to provide basic information such as your name, email address, and credit card details. Once you’ve created an account, you can log in to access all the features the portal has to offer. The mycardstatement portal allows you to manage your card payments and statement history, view transaction details, and make payments with just a few clicks.

1: You need a gadget like a mobile phone to log in to the portal

In order to access the mycardstatement portal, you will need a device like a mobile phone or tablet with internet access. Logging in requires your username and password and it’s important to have the correct device for entering these details securely. Having a mobile device is also convenient as it allows you to quickly check your account from wherever you are.

2: You need a strong internet access

For Mycardstatement to run efficiently and securely, you must have a reliable internet connection. Without a good internet connection, your account information may be at risk of being compromised. An excellent internet connection ensures that all data is transferred securely and that no malicious actors can access your account. Additionally, having a strong internet connection prevents lags or disruptions in the service. As such, it is highly recommended that you invest in a good internet connection to get the most out of Mycardstatement.

3: You need a verified email address

In order to use the mycardstatement portal, you will need a verified email address. This is so that you can securely access your account and receive important notifications from the portal. Verifying your email address may vary based on your provider, but generally, it involves confirming a link sent to your email or inputting a verification code. Once your email address is verified, you will have complete access to the mycardstatement portal.

4: Credit card details are also required

Credit card details are an essential requirement when registering for Mycardstatement. This includes the credit card number, expiration date, security code, and billing address. All of these details must be entered correctly in order to use the portal. The billing address must also match the address on file with the credit card issuer. It is important to note that the information provided must be accurate to avoid any potential fraud issues or other account-related issues. Mycardstatement also requires users to keep their credit card information up-to-date to ensure the best possible experience with the portal.

Basic guidelines for accessing your mycardstatement account

Here are some basic guidelines:

1. Registration:

The first step to using mycardstatement is registering for a free account. You will need to provide basic information, such as your name, address, email address, and the bank or credit card you want to use with the service. Once you have done this, you must confirm that the information is correct before submitting it.

2. Login:

Once your registration has been approved, go back to the site and enter your username (or email) and password to log in. Then click on Sign in. You should then be presented with a blank page that says Dashboard. Clicking on Dashboard will bring up another page of panels titled Account Summary, Activity, Cashflows, etc., each representing an area of management for which there are individual tabs at the top of each panel that allow you to switch between them easily.

Conclusion

In conclusion, Mycardstatement is a highly beneficial platform for managing your credit card statements and payments. It is easy to register, secure to log in, and provides users with various features that simplify life. Through the portal, you can access multiple features such as customizing payment schedules, viewing payment history and monitoring your credit score. Furthermore, the portal follows basic security guidelines to protect the privacy of its users.

Mycardstatement is an excellent choice for individuals with greater control over their credit card statements and payments.