Are you looking for an easy and secure way to access your money? The MyCardStatement Access Card is the perfect solution for you! With this card, you can easily make purchases, withdraw cash, and check your balance anytime.In this article, we will discuss the advantages of the MyCardStatement Access Card and how you can access your card through My Card statement.

What is MyCardStatement?

MyCardStatement is a convenient, secure, and easy-to-use online service that allows you to access and manage your credit card account information. This free service lets you view up-to-date balance information and recent transactions, make payments, and more.

MyCardStatement is also great for managing your credit card spending and keeping track of your account activity. With this online service, you can easily keep track of your account, review past payments, and make payments on time.

With MyCardStatement, you can access your account 24/7 from any device with internet access. You can check your account information, make payments, and transfer funds to other accounts. Plus, you will receive notifications when your payment is due or if there are any changes in your account.

How to Access Your Credit Card Account?

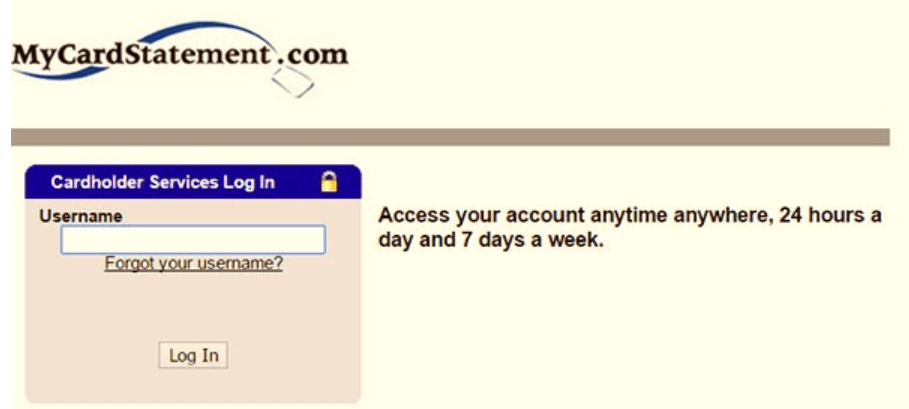

Accessing your credit card account online has never been easier. With MyCardStatement, you can quickly and easily view your account details, check your balance and transaction history, and manage your account securely online.

To begin, log into the MyCardStatement website using your account credentials. Once you have logged in, you will be taken to the My Account page, where you can review your account information and manage your settings. You can view your available credit, outstanding balance,

payment history, and more.

VISA Credit Card Payment Alternatives

The MyCardStatement Login portal allows credit cardholders to make online payments using their registered credit cards. Here are the details:-

Payment by phone:

IVR payments: 844-386-8276

CSR Payment: 844-386-8276 (fee for paid service:$10.00 )

ACH AutoPay:

- You can commit to monthly fixed rates.

- Monthly loan interest rate

- Small payments

- Online access at www.mycardstatement.com

Pay in cash at one of the local banks or at the bank.

You are advised not to use the account in any way that could leave the outstanding balance beyond the established credit limit. As such, they will refuse to honor any more purchases if the due balance exceeds your appropriate credit limit.

Benefits of MyStatement card access

Here we are talking about Benefits of MyStatement card access:

Make direct payments

You can also make payments directly from the MyCardStatement website. To do this, click on the Make a Payment link at the top of the page and enter the amount and payment method you would like to use. After entering the required information, click Submit Payment to finalize the process. Your payment will be applied to your account immediately.

View transactions

If you need to view a transaction or find additional details about a purchase or payment, you can do so by clicking on the Transactions tab at the top of the page. Here, you can view all recent transactions and sort them through filters such as date range, category, type, and more.

Leave a Reply